Federal Tax Threshold 2025. The top marginal income tax rate. Individual brackets were determined by filing status and.

The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

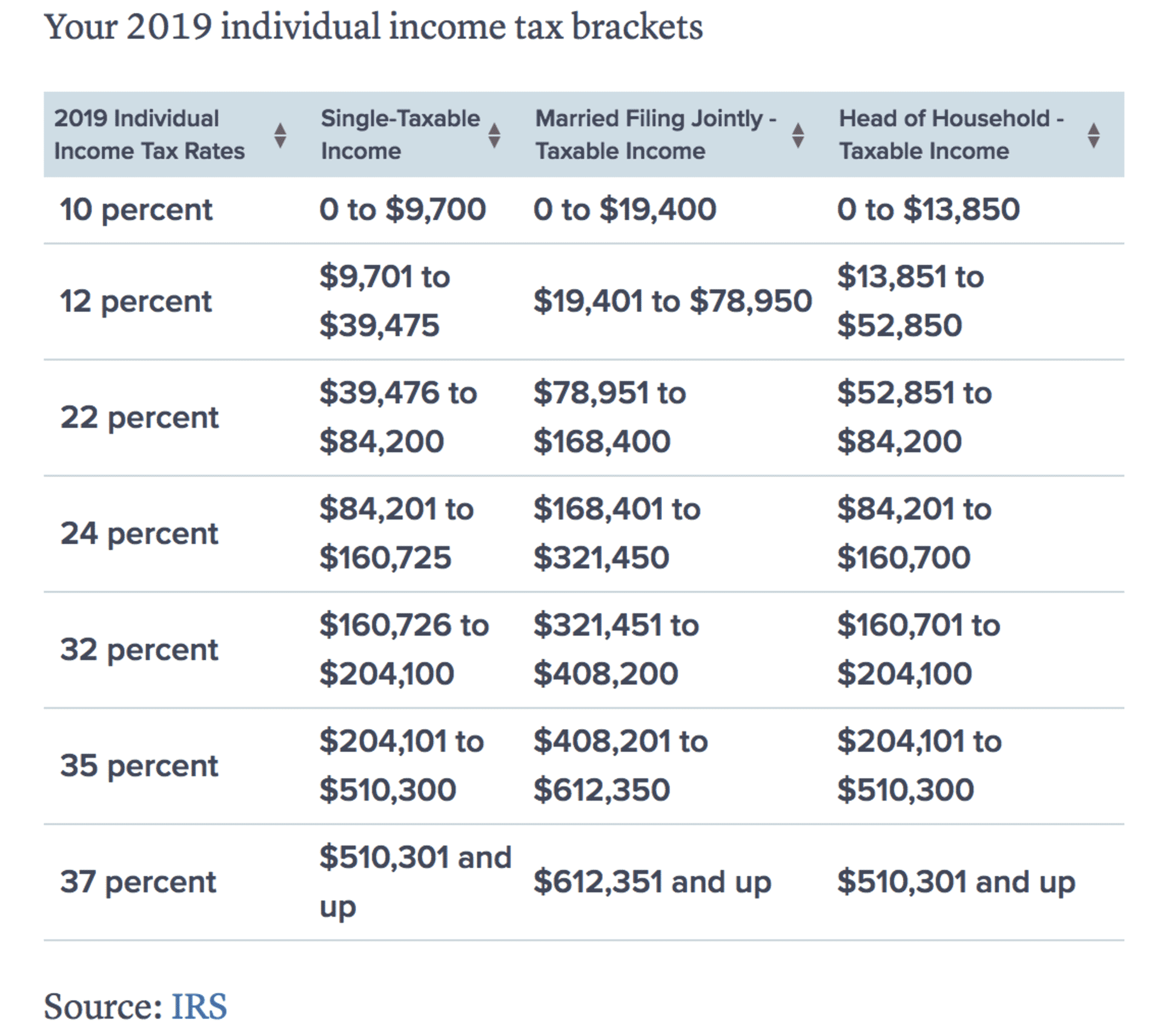

Federal Tax Revenue Brackets For 2025 And 2025 Nakedlydressed, 37% for incomes over $609,350. The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the 2025 tax year.

Federal Tax Filing Threshold 2025 Printable Forms Free Online, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Here's how those break out by filing status:

Tax Calculator California 2025 Barb Marice, Given the complexity of the new provision and the large number of individual taxpayers affected, the irs is planning for a threshold of $5,000 for tax year 2025 as part of a. For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

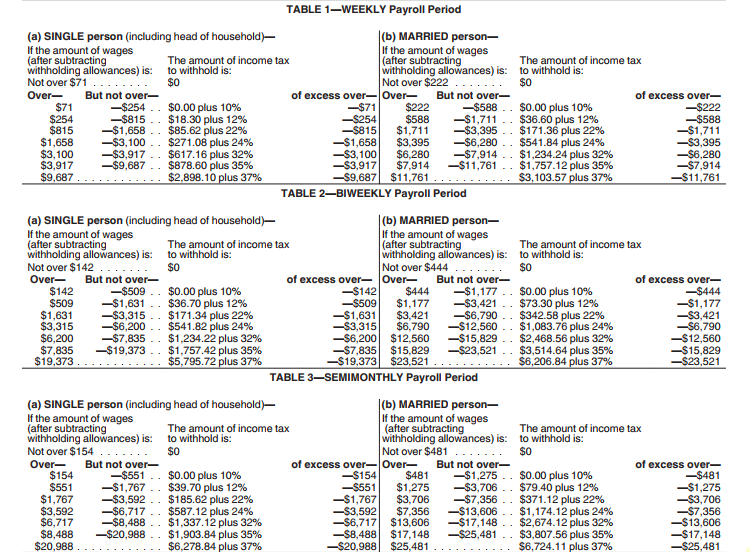

Federal withholding tax table Wasdel, The federal income tax has seven tax rates in 2025: For single filers in 2025, all income between $0 and $11,600 is subject to a 10% tax rate.

What Is 2025 Withholding Calculator IMAGESEE, The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: Tax year 2025 filing thresholds by filing status.

2025 Tax Rates & Federal Tax Brackets Top Dollar, Individual brackets were determined by filing status and. Come wednesday morning, that price jumped 13 cents a litre.

Navigating the Changing Federal Estate Tax Threshold Johnson, Page last reviewed or updated: The federal standard deduction for a married (joint).

What Tax Bracket Am I In Here S How To Find Out Business Insider Africa, Below, cnbc select breaks down the updated tax brackets for 2025 and what. Page last reviewed or updated:

Federal Budget 202324 Personal tax Pitcher Partners, The federal federal allowance for over 65 years of age single filer in 2025 is $ 1,950.00. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

2025 Easy Federal Tax Update • 8 Hrs CPE Credit, There are seven federal tax brackets for tax year 2025. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

If you have $11,800 in taxable income in 2025, the first $11,600 is subject to the 10% rate and the remaining $200 is subject to the.

On 22 march 2025 the german federal council approved a revised version of the growth opportunities act.the scope of the final bill was reduced.